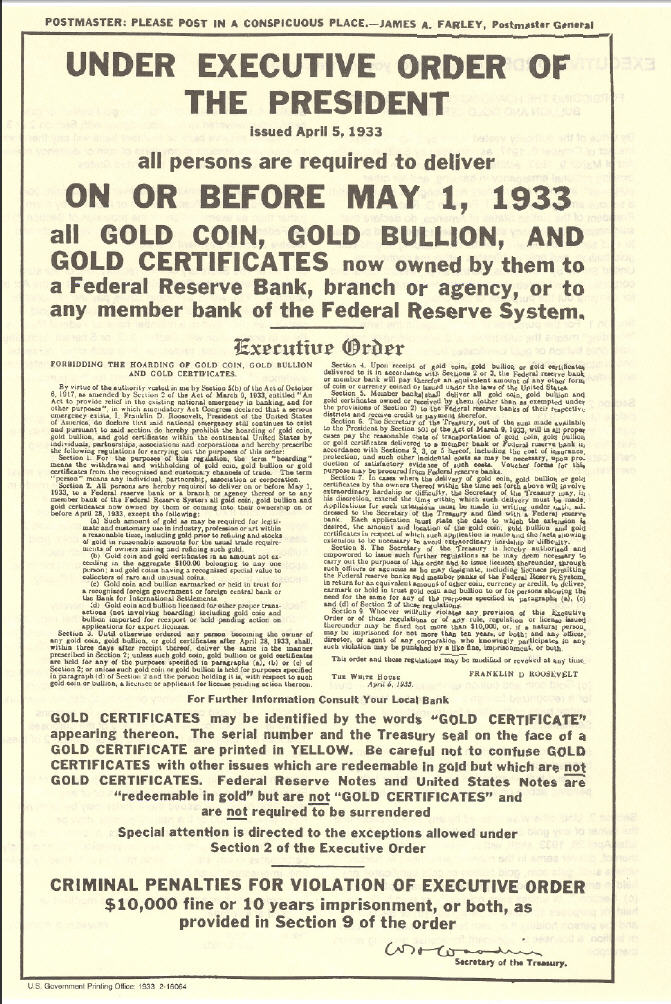

Perhaps the most stunning example of what may be in store for asset managers and pension funds (and possibly retail holders) who dare to challenge central bank monetary authority comes from the Netherlands, where we have just witnessed the 21st century equivalent of Executive Order 6102. The story in a nutshell (and as translated loosely from the primary source presented below): the glassworkers pension fund (SPVG) was ordered by De Nederlandsche Bank (DNB, or the equivalent of the Dutch central bank), that it has to sell the bulk of its gold assets. After the SPVG refused to comply with the order, the DNB went to court and the decision has come out, siding with the central bank, ordering the SPVG to sell the required gold within two months. The pension fund, which invests for 1142 employees, in late 2009 had gold bars worth 34.6 million euros, or about 1400 kilograms. The total fund assets amounted to 288 million euros at that time. The DNB argued gold is a commodity and holding 13 percent was overweight in comparison to the 2.7% average that pension funds are invested in commodities. DNB has found that such a large proportion of gold is inconsistent with the interests of the participants. SPVG sees gold as a medium of exchange, such as euros, but DNB believes that the price of gold fluctuates too much for it to be classified as an investment. Translation of the translation: the central bank has now directly ordered a fund how to allocate its gold assets, because it explicitly disagreed with the fund's statement that gold is money, claiming instead that it is nothing but a very volatile commodity. Very soon no pension funds in the Netherlands will be allowed to hold any amount of gold more than the merely nominal. This latest gold confiscation equivalent event is most certainly coming to a banana republic near you. - ZH

Translated via Google Translation web service:

LJN: BP3625, Rotterdam Court, AWB 11/455 VBC-T2 Print statement

Date of decision: 02.08.2011

Publication date: 09/02/2011

Jurisdiction: Administrative Other

Type of procedure: Provisional

Inhoudsindicatie: DNB pension fund an indication its assets in gold continued to build - depending on the final asset mix to put together - to a rate between 1 and 3%. Although the Fund may be nagegeven that the reasoning of the contested decision brief, is the provisional opinion of the judge in court adequately substantiated why DNB considers that the fund has invested in gold to an extent that an excessive reliance under The fifth paragraph of Article 13 of the Financial Assessment Framework Decision pension yields. In the opinion of DNB provides an investment of 13% of assets in the category of commodities, which that investment is also limited to a commodity, an excessive dependence on the development value of that commodity. DNB notes in this context that pension funds invest on average 2.7% in the category of resources. It also points to the volatility of gold it appears from the plan submitted by the ALM study. The proposition of the Fund rather than gold as a raw material but as a bargaining chip should be seen doing in the opinion of the judge, given the strong volatility of insufficient alter the argument of DNB.

Ruling

LONDON COURT

Administrative Sector

Relief Judge

Reg.nr.: AWB 11/455 VBC-T2

Ruling in response to the request for provisional relief under Article 8:81 of the General Administrative Law

In the case of

Pension Fund United Glassworks, in Gorinchem, the applicant (the Fund)

Agent Prof. E. Lutjens, Amsterdam Bar,

and

De Nederlandsche Bank SA, the defendant (DNB)

Agent Mr. C.M. Bitter, a lawyer in The Hague.

1 Origin and course of the proceedings

By decision of 20 January 2011 DNB indication that the Fund seeks to fund its investment in gold continued phasing out - depending on the final asset mix to put together - to a rate between 1 and 3%. The fund shall submit a plan to draw within two weeks after publication of the designation must be received by DNB. The fund should then plan to be implemented according to the schedule provides a timeline of up to two months after submission to DNB.

Against this decision (hereinafter the contested decision), the fund has any objection.

It has also asked the judge to take a provisional, which includes suspension of the contested decision.

The court hearing took place on February 3, 2011. Parties to be represented by their agent. Furthermore, on behalf of the fund appeared ir D. Ek, who works at Mercer Netherlands BV and adviser to the fund. On behalf of the fund are also some members of the board appeared. DNB on behalf of three employees who appeared under H. Chick.

2 Considerations

2.1 Under Rule 8:81, the first member of the General Administrative Law Act (the AWB) if the court decides against an appeal or, prior to a possible appeal to the court, objection was made or administrative proceedings, the judge of the court having jurisdiction or may be in the main, to request a provisional arrangement where urgency, given the interests involved, is required.

Where the purpose to carry out scrutiny requires that the lawfulness of the contested decision is assessed, has the discretion of the judge is a provisional and not binding on considers that the appeal decision or possibly in the main.

2.2 pursuant to Article 171, first paragraph, of the Pension Act, DNB a pension which does not meet stipulated by or pursuant to that Law, by giving a clue oblige within a supervisory reasonable period with respect to in the designation order points out a certain course of action.

2.3 Article 135 of the Pension Act reads:

"1. A pension fund carries an investment policy consistent with the prudent-person rule and in particular based on the following principles:

a. The values are invested in the interest of entitlement and pension beneficiaries, and

b. (...);

c. The investments are valued based on market valuation.

2. By or pursuant to a Board shall be to ensure the prudent investment policy further rules.

3. The (...) rules under the second paragraph are made regarding the diversification of values do not apply to investment in bonds. "

In the explanatory memorandum of the Pensions Bill includes the following observations (Papers II 2005/06, 30 413, No. 3, p. 258-259):

"The content of this article is based on Article 9BA, as recognized in the Bill to implement Directive 2003/41/EC (II 2004/05, 30 104, No. 2). The investment policy of a pension should be based on the prudent person rule. The prudent person rule is not defined by the Directive. The directive sets out a number of assumptions. The line is best approached on the idea that the values are invested in such a way that the safety, quality, liquidity and profitability of the portfolio as a whole. Also, the values to be invested solely in the interest of the claim and the beneficiaries. (...) "

2.4 Article 13 of the Financial Assessment Framework Decision pension funds (hereinafter: Decision FTK) reads, so far as relevant:

"1. The values are invested in such a way that the safety, quality, liquidity and profitability of the portfolio as a whole are ensured.

2. Values that cover the technical provisions are held to be invested in a manner consistent with the nature and duration of the expected future retirement benefits.

(...)

5. The values are properly diversified so that an excessive reliance on or faith in certain values, or values of a particular issuer or group of undertakings and accumulations of risk in the portfolio as a whole.

(...) "

2.5 On 18 August 2010 at the invitation of DNB a conversation held with a delegation from the board of the fund. During this conversation, DNB has informed the Fund that the fund is too much of the investment portfolio invests in only a "sub-asset class, namely gold, and that therefore there is a concentration risk. In the opinion of DNB, this investment because the risk is not in the interests of participants of the investment fund and should be phased out. The fund has announced the vision of DNB DNB not to endorse. After correspondence back and forth, DNB has the contested decision.

2.6 The fund argues that it is not in violation. It states in this regard that DNB should look at the portfolio as a whole. The fund argues that the goal is to create security for the participants. Because AEX currently very uncertain, it is precisely in favor of gold because it has proved a wise investment. If the fund in 2008 its shares had traded fund for gold would be in a situation of serious underfunding are making conditions, while thanks to the purchase of gold by December 2010 a coverage ratio of 104.7%, higher than the minimum required power. The fund is adequately equipped to monitor the development of the gold price and recently a study done by the ALM policy of the fund supports. The Fund believes that DNB wrongly assumes a concentration risk. Furthermore, argues the fund that there is an unreasonable belangenafweging DNB now fund just very carefully proceeded to the purchase of gold, she has acted in the interest of all participants, in what context they suggesting that the participants' council is behind the management of the fund has ranged, and DNB already using the fund's annual report for 2008 was aware of the investment in gold.

2.7 Although the Fund may be nagegeven that the reasoning of the contested decision brief, is the provisional opinion of the judge in court adequately substantiated why DNB considers that the fund has invested in gold to an extent that an excessive reliance meaning In the fifth paragraph of Article 13 of the Framework Decision yields. From that provision in conjunction with Article 135 of the Pensions follows that - except for investments in government bonds - in the investment portfolio diversification is considered important in the interpretation of the prudent person rule. This diversification is to DNB traced back to the premise that a diversified investment portfolio across different asset classes and different regions, a stabilizing influence on the investment performance, without sacrificing the expected return. In the opinion of DNB provides an investment of 13% of assets in the category of commodities, which that investment is also limited to a commodity, an excessive dependence on the development value of that commodity. DNB notes in this regard datpensioenfondsen average of 2.7% investment in the commodity category. It also points to the volatility of gold it appears from the plan submitted by the ALM study. According to the DNB does not predict when and to what extent a decline will continue. If the gold price implode then the ratio of the fund drop to below 100%. DNB has also stated in court that the fund in which a long-term recovery plan is applicable to this concentration risk acting in breach of Article 16, second paragraph of the Framework Decision. The proposition of the Fund rather than gold as a raw material but as a bargaining chip should be seen doing in the opinion of the judge, given the strong volatility of insufficient alter the argument of DNB.

2.8 DNB's opinion, the judge hearing the criticism of the fund were inadequate eye for the entire assets of the fund invested sufficiently refuted. DNB has argued in this respect that the fact that a large proportion of the fund or in accordance with the Pension invested does not affect the concentration risk that the gold position poses a real risk that the entire capital falls below the required coverage.

2.9 In preliminary opinion of the judge, DNB rightly come to the conclusion that there is a concentration risk under the fifth paragraph of Article 13 of the Framework Decision. The DNB has the financial statements of the fund in 2008 could infer that the fund is too much - then 5% - of the wealth in gold has invested is the opinion of the judge not that DNB is not currently a designation may come. First, the Fund substantially expanded its gold position in 2009, so that more action was pregnant, and secondly, the fund is based on a responsibility to invest within the frameworks of the Pensions Act and the Decree FTK offer. In addition, DNB has not taken immediately to enforcement tools, but it first through consultation sought to move the fund to build its gold position. Finally, the judge found that the fund is not an unreasonable period is needed for its gold position to build.

2.10 The judge will therefore reject the request.

2.11 The judge sees no reason for a court conviction.

3 Decision

The judge,

hereby:

reject the application for a preliminary injunction off.

Thus done by Mr. T. Damsteegt, judge, in the presence of drs R. Stijnen, Registrar.

The Registrar: The judge:

Spoken in public on: February 8, 2011.

Against this ruling is not subject to appeal.

No comments:

Post a Comment